![]()

Ctrl + P

Reports > Print

The GST report is separated into two sections: GST Invoiced (accrual accounting) and GST Received (cash accounting). The report has been designed this way so that users will benefit from it, whichever accounting method they use.

How the GST Report is Defined

The GST report is calculated based on date of entry. This means, for example, that a GST-inclusive Tax Invoice generated on 1 July, for a service that was provided on 30 June, will be included in a report covering the month of July, but not in a report covering the month of June.

How to Generate a GST Report

1. Either

o Click

o Press Ctrl + P

o Select Reports > Print

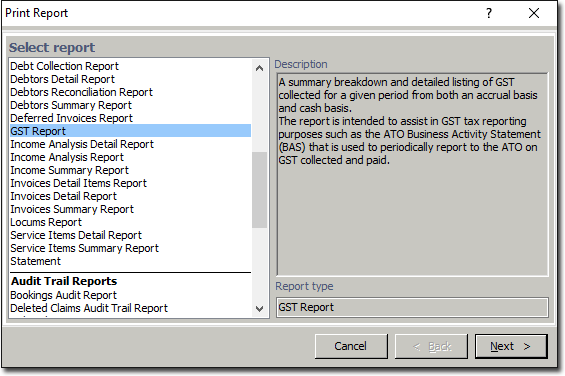

2. The Print Report window appears.

3. Select GST Report from the list of reports and click  The Print GST Report window appears.

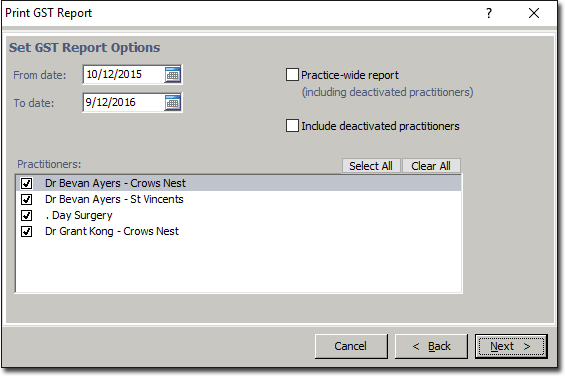

The Print GST Report window appears.

4. Enter the date range for the report.

5. Next to Practitioner there are two option buttons, labelled All and Specific. If every Practitioner on your system has given you permission to print their earnings reports, then both options will be available to you. If, however, not every Practitioner has given you this permission, then the option button next to All will not be enabled. In this case, you will only be able to select from the list of Practitioners who have given you this permission.

6. If you have selected All, click  select the appropriate printer, tray and number of copies and then click

select the appropriate printer, tray and number of copies and then click  again to print the report.

again to print the report.

7. If you are limited to, or have chosen Specific, select the check boxes next to the Practitioners you wish to print reports for. Click  select the appropriate printer, tray and number of copies and then click

select the appropriate printer, tray and number of copies and then click  again to print the report.

again to print the report.

8. Click  Ensure that the correct printer, tray and number of copies are selected, and then click

Ensure that the correct printer, tray and number of copies are selected, and then click  again to print the report.

again to print the report.

How to Interpret this Report

The GST Invoiced section reports the dollar amounts of invoices where GST was involved, and the GST input for those amounts. It also takes into account, and subtracts, any write-offs or discounts that may have been applied.